Portfolio weight calculator

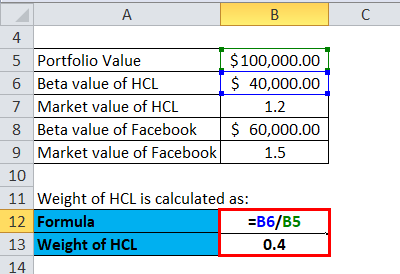

Put the formula C2 A2 in cell E2. Calculating Portfolio Weight To get the market value of a stock position multiply the share price by the number of shares outstanding.

Optimization Formula For Optimal Portfolio Of 2 Assets When No Shorting Allowed Quantitative Finance Stack Exchange

The tool calculates the optimal.

. To compute the portfolio weight of each investment repeat the calculation in successive cells dividing by the value in cell A2. The portfolio weight of each investment represented as a percentage of the portfolios total value The last two sets of figures can be used to estimate portfolio returns. Following this formula for stocks and.

Simply divide each of your stock positions cash value by your total portfolio value and then multiply by 100 to convert to a percentage. First determine the value of the given asset. If Apple is trading at 100 and 548.

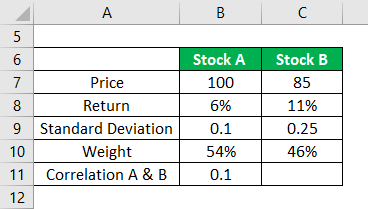

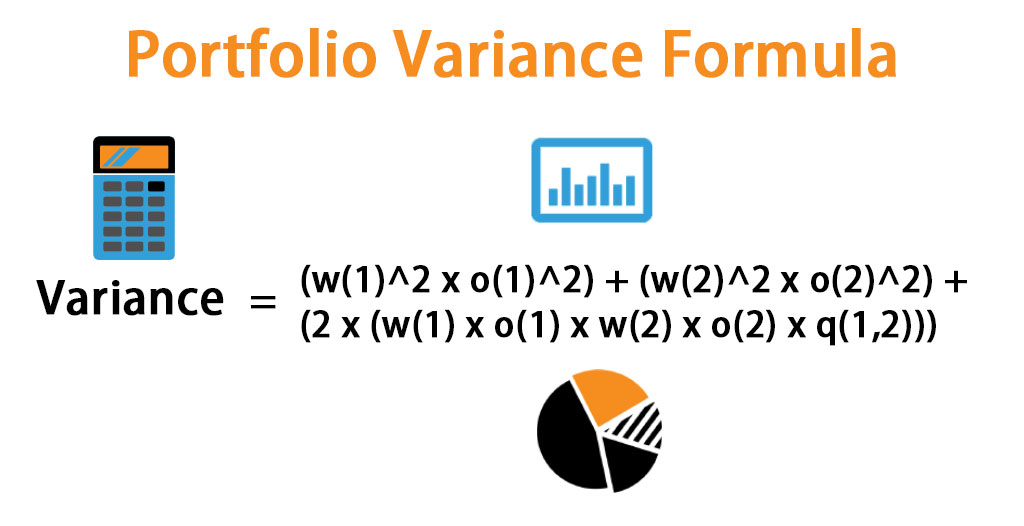

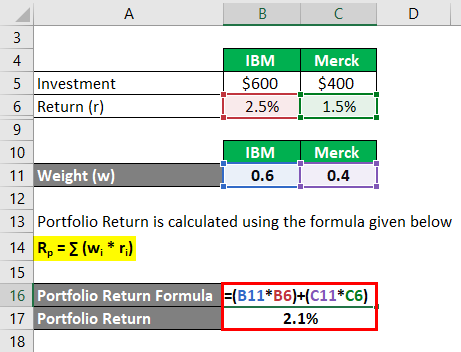

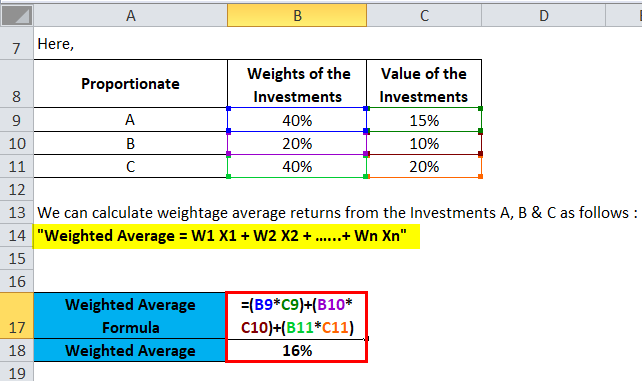

This section of the worksheet allows you to enter the amount to invest and it will use the Optimal Portfolio weights to calculate the amount to invest in the Riskless Asset Asset 1 and Asset 2. Using the above formulas we then calculate the portfolio expected. Consider an investor is planning to invest in three stocks which is Stock A and its.

You can also use the Black-Litterman model based. The required inputs for the optimization include the time range and the portfolio assets. Now that we have the return and weight of each investment we need to multiply these numbers.

User-friendly Excel tool for the calculation of the theoretical optimal portfolio weights for up to 25 securities using Modern Portfolio Theory. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

W1 and W2 are the percentage of. Built for Traders by Traders. Next determine the value of the entire portfolio.

Portfolio Return 60 20 40 12 Portfolio Return 168 Portfolio Return Formula Example 2. Denotes the weight or proportion. Contribute to youngf-GitHubPortfolio-Weight-Calculator development by creating an account on GitHub.

Reflects the Beta of a given stock asset and. For calculation of the portfolio weight in an investment portfolio based on the number of units you have to simply divide the number of units of a specific asset by the total number of units of. Armed with the above information you can calculate the weighted expense ratio of your portfolio of funds.

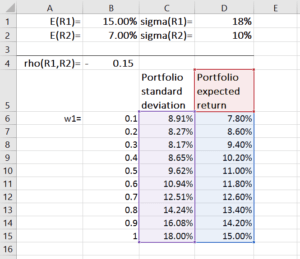

Portfolio asset weights and constraints are optional. You can calculate Portfolio Beta using this formula. To construct a portfolio frontier we first assign values for ER 1 ER 2 stdevR 1 stdevR 2 and ρR 1 R 2.

Represents the Beta of the portfolio. The weightage of the respective assets in the portfolio the standard deviation of those assets as well as the covariance of. For real estate we will multiply 56 by 10 to get 56.

This money-weighted rate of return excel calculator is an easy-to-use. To do this divide the expense dollar amount of 345 by the total. The Two Asset Portfolio Calculator can be used to find the Expected Return Variance and Standard Deviation for portfolios formed from two assets.

The following steps outline how to calculate the Portfolio Weight. However manually calculating your investment portfolios money-weighted rate of return is not a trivial task. Explore Tools That Allow You To Access Insights On Retirement Concerns.

Contribute to youngf-GitHubPortfolio-Weight-Calculator development by creating an account on GitHub. Ad Our Resources Can Help You Decide Between Taxable Vs. The calculation is simple enough.

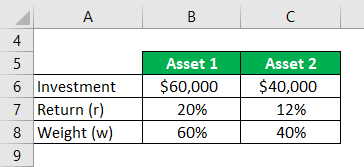

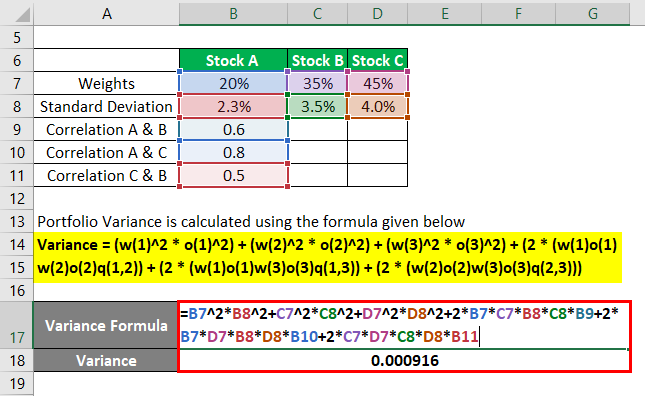

Therefore portfolio risk calculation includes three main variables. Next gather the formula.

Portfolio Variance Formula How To Calculate Portfolio Variance

Portfolio Return Formula Calculator Examples With Excel Template

Finance Problem Determining Portfolio Weights Youtube

Portfolio Variance Formula How To Calculate Portfolio Variance

2

Portfolio Beta Calculator Marketxls

Calculating A Sharpe Optimal Portfolio With Excel

Portfolio Variance Formula How To Calculate Portfolio Variance

Beta Formula Calculator For Beta Formula With Excel Template

Portfolio Return Formula Calculator Examples With Excel Template

Calculating A Sharpe Optimal Portfolio With Excel

How To Calculate Your Time Weighted Rate Of Return Twrr Canadian Portfolio Manager Blog

How To Find Efficient Frontier Capital Allocation Line Optimal Portfolio

Money Weighted Rate Of Return Calculator With Excel Sheet

How To Beta Weight Your Stock Portfolio Otosection

Weighted Average Formula Calculator Excel Template

How To Calculate Your Portfolio S Beta Weighted Delta Aussie Stock Forums